Since the cost of acquiring the products is increasing, the organization wants to determine whether it must increase the price of the t-shirts. By no means is meant to be hailed as a definitive document of every aspect of your company’s financial future. If you want a clearer, more accurate picture of where your company is headed financially, you’re better off carefully detailed, line-by-line forecast that considers other aspects beyond your sales level. Next, Liz needs to calculate the percentage of each account in reference to her revenue by dividing by the total sales.

- Our CRM platform is user-friendly, compatible with existing software, and workable with hundreds of additional software companies.

- The use of the percentage of sales method will help in determining the required amount of external financing.

- Financial forecasting, like financial planning, is based on financial analysis.

- This is because they are directly affected by an increase or decrease in sales volume.

- It also can’t consider other financial changes like future bad debts that might impact sales.

Determine asset and expense amounts based on revenue increase

It also can’t consider other financial changes like future bad debts that might impact sales. If you want to make financial planning decisions based on your business’s historical performance, then the percentage-of-sales method is your new best friend. Especially when it comes to creating a budgeted set of financial statements.

Note all assets and expenses that impacted sales during that period, along with amounts

Say Jim runs a retail running shoe store, and has the following line items he wants to forecast. Lenders also find this to be a useful metric for determining how much external financing a business can reasonably pay back. Here are some of the reasons the percentage-of-sales method might not be for you. It’s a quicker method because of its simplicity, so some businesses prefer it to other, more complex techniques. The best part of this method is it doesn’t need loads of data to work, just the prior sales and a calculator (or software, if you want to make life easier).

Determine your estimated growth and most recent annual sales figures.

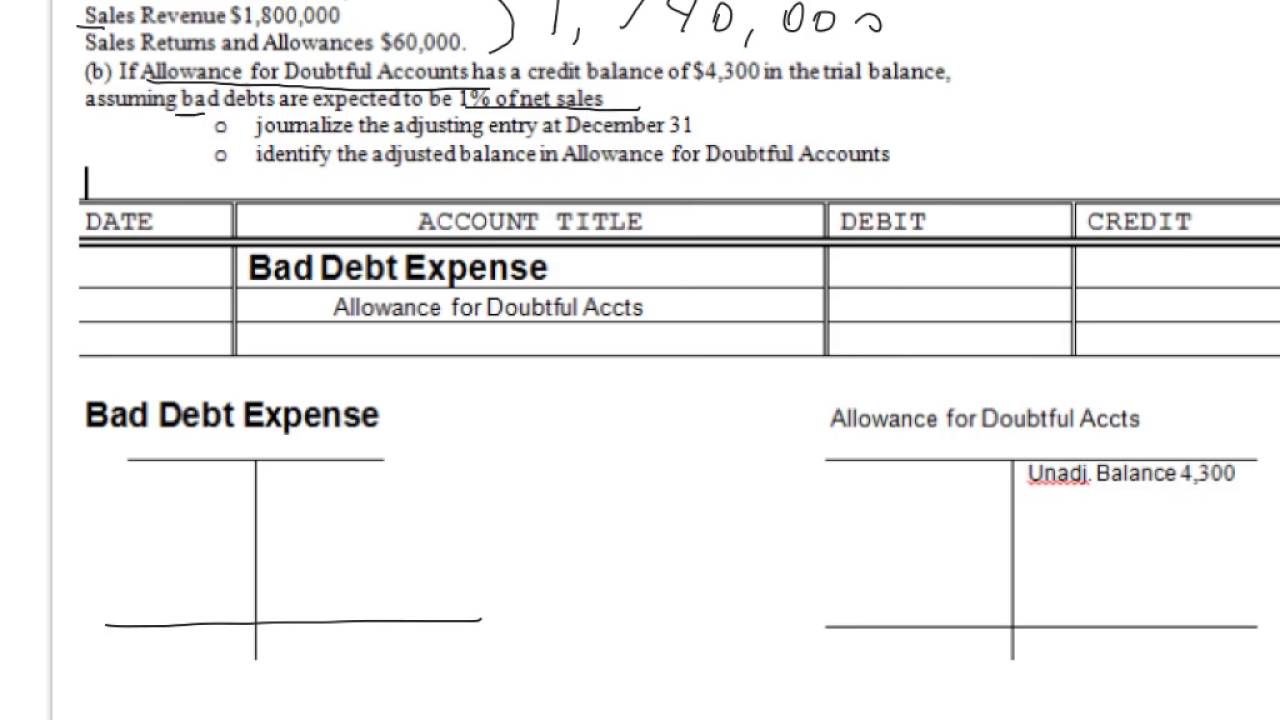

The use of the percentage of sales method will help in determining the required amount of external financing. Companies with credit sales will want to keep tabs on their accounts receivable to ensure bad or aged debt isn’t building up. This method just focuses on accounts receivable and can complement the percentage-of-sales calculations.

We’ll also show you a real-life example, highlighting its benefits and drawbacks. Frank wants to see the percentage of sales for his expenses specifically so he goes back to his initial amounts and sees that expenses totaled $20,000, or 20% of revenue. Suppose Panther Tees is a t-shirt retailer that sells t-shirts directly to consumers via its online platform.

Forecasting Models to Leverage for Better Sales Forecasting

The common size percentages can be subsequently compared to those of competitors to determine how the company is performing relative to the industry. Now that you’ve calculated your year-end average A/R balance, you can use this to calculate your company’s ACP and understand the relationship between these figures. In other words, they represent the earnings after dividends have been deducted. The standard figure used in the analysis of a common size income statement is total sales revenue.

A common size income statement makes it easier to see what’s driving a company’s profits. The common size percentages also help to show how each line item or component affects the financial position of the company. The percentage of sales method is a forecasting tool that makes financial predictions based on previous and current sales data. This data encompasses sales and all business expenses related to sales, including inventory and cost of goods.

Management usually determines the budget’s percentage figure, which is based on the industry average or the company’s historical or previous year’s advertising spending. In other words, if you are going to sell more, you will need more inventory and your cost of goods sold will also rise. To be able to produce more you are also going to involve more fixed assets and might need to accumulate more accounts payable to make everything happen. Since, in most cases, businesses provide their customers with an opportunity to buy on credit, as they sell more, their Accounts receivable also grows. Thus, the resulting ratios, taking into account the planned sales volume, are then used to compile the forecasted financial statements.

One of your goals as a business owner is to increase your sales percentage to grow your business and stay competitive. Adopting smart strategies can improve your sales performance and boost your revenue. While it offers a good starting point, it’s essential to use this method alongside other forecasting techniques. From there, she would determine the forecasted value of the previously referenced accounts. Once she has the specific accounts she wants to keep tabs on, she has to find how they stack up to her overall sales figures. Well, one of the more popular, efficient ways to approach the situation would be to employ something known as the percent of sales method.

The two financial statements that analysts common size most often are the income statement and the balance sheet. The free profit and loss form free to print save and download is one of the steps in financial planning. The essence of the method is that each of the elements of the financial documents is calculated as a percentage of the established sales value. It is one of the simplest and most effective methods of financial forecasting of an enterprise. Using this method, it is possible to determine the need for external financing, the participation of the organization’s financial structures in future financial transactions, and profit forecasting.